What is return on investment. Investor profitability: investment or speculation? What is investment

Investing in various assets is one of the most popular types of income. However, it requires a fairly high level of financial literacy. Successful investment requires not only making the right investment decisions, but also being able to evaluate the results from investing funds. This will allow making a qualitative analysis and, if necessary, making changes to it in a timely manner. This approach to investment activity will increase its efficiency, and hence the investor's income. The main indicator of any investment is the return on investment. What it is and how to calculate it will be discussed in this article.

Types of investment returns

Return on investment is an indicator that reflects the degree of increase in the investor's invested funds over a certain time period. It can be expressed in currency and as a percentage. In this regard, there are two types of investment income: interest and value.

Interest income is interest accrued on funds invested in deposits, bonds, shares (dividends).

Value return is the increase in the value of an asset in which an investor has invested his money.

I'd like to point out that some assets combine both types of return. For example, stocks of companies. can receive dividends and earn on the rise in the value of securities.

Formulas for calculating the return on investment

There are several formulas that can be used to assess the performance of an investment. We will consider the most important ones.

The basic formula for profitability looks like this:

D \u003d (P / SV) x 100%

The profit (P) received from investments is divided by the total amount of funds invested in the asset (SV) and multiplied by 100 percent. If, instead of profit, a loss was received, then, accordingly, the indicator will have a negative value. However, this formula has a significant drawback. It does not take into account such a parameter as time. If, for example, the return was 28%, then it is difficult to estimate it without taking into account time. If it is obtained in a year, then this is a very good result, and if it is obtained in several years, then the indicator is very low.

In order to take into account the time factor, you must use a different formula. It determines the return on investment as a percentage per annum. This formula looks like this:

D \u003d (P / SV) x (365 / KD) x 100%

It differs from the previous formula in that we multiply the resulting profitability by a time coefficient. It is determined by dividing the total number of days in a year (365) by the number of days the asset is held. The calculation of profitability in percent per annum allows you to compare the effectiveness of investments in assets that have different periods of ownership.

For long-term investments, it will be useful to calculate their average annual return. This is done according to the formula:

JV is the amount of funds received from the sale of assets;

DV is cash payments that the investor received during the investment period;

SV - the total amount of investments;

n is the number of years of asset ownership.

How to calculate the return on investment? - this question interests every investor. The main thing is earning income, so it is always interesting how much you earned and what your profitability is. Compared by yield, stocks, bonds, deposits, real estate and many others. Any investor, trader or manager is interested in its effectiveness. Banks, management companies and brokers, when advertising their services, like to lure customers with high interest rates. Profitability is one of the most important indicators by which you can assess the effectiveness of investments and compare with other investment alternatives. So, let's figure out what the return on investment is and how to calculate it.

Profitability (rate of return, rate of return) is the degree of increase (or decrease) of the invested amount over a certain period of time. Unlike income, which is expressed in nominal terms, that is, in rubles, dollars or euros, the yield is expressed as a percentage. Income can be received in two forms:

- interest income is interest on deposits, coupons on bonds, rent on real estate;

- an increase in the value of purchased assets - when the selling price of an asset is higher than the purchase price - this is real estate, gold, silver, oil and other commodity assets.

Assets such as real estate, stocks and bonds can combine two sources of income. The calculation of profitability is needed to assess the growth or decline of investments and is a criterion for assessing the effectiveness of investments.

How to calculate the return on investment?

In general terms, profitability is always calculated as profit (or loss) divided by the amount invested, multiplied by 100%. Profit is calculated as the amount of the sale of the asset - the amount of the purchase of the asset + the amount of cash payments received during the period of ownership of the asset, that is, interest income.

Formula 1

An example of calculating the return on investment.

We bought a share at a price of 100 rubles (investment amount), sold a share at a price of 120 rubles (sale amount), and received 5 rubles in dividends (cash payments) during the period of holding the share. We calculate the yield: (120-100 + 5) / 100 \u003d 0.25 * 100% \u003d 25%.

Formula 2

There is a second formula, according to which profitability is calculated as the sum of the sale of the asset + the amount of cash payments divided by the amount of investments, minus 1, multiplied by 100%.

An example of calculating the yield: (120 + 5) / 100 - 1 * 100% \u003d 25%.

How to calculate the yield as a percentage per annum?

The formula for calculating simple profitability does not take into account such an important parameter as time. 25% can be received in a month, or in 5 years. How, then, is it correct to compare the returns on assets with different holding times? For this they count. The annual percentage rate of return is calculated to compare the performance of assets with different holding times against each other. The rate of return per annum is the rate of return reduced to a single denominator - the rate of return for the year.

For example, a bank deposit gives 11% a year, and some shares brought 15% for 1.5 years of ownership, which was more profitable? At first glance, the shares, after all, they brought more profitability. But the investor owned them for more than six months, so their profitability seemed to be stretched over time compared to the deposit. Therefore, in order to correctly compare the deposit and shares, the profitability of shares must be recalculated as a percentage per annum.

To do this, a 365 / T coefficient is added to the formula, where T is the number of days the asset is owned.

An example of calculating profitability:

We bought a share for 100 rubles, sold it 1.5 years later for 115 rubles. 1.5 years is 1.5 * 365 \u003d 547 days.

(115-100) / 100 * 365/547 * 100% \u003d 10%. In this case, the deposit turned out to be slightly more profitable than shares.

How forex, asset management companies, brokers, and banks manipulate annual returns.

In any advertisement of profitability, pay attention to the footnotes, specify what profitability is indicated in the advertisement and for what period. For example, an advertisement sounds like a yield of 48% per annum. But it can be received in just one month. That is, the company earned 4% in a month and now proudly advertises a product that gives 4 * 12 \u003d 48% per annum. Even you, having earned 1% per day on the stock exchange, can boast that you have earned 365% per annum) Only this profitability is virtual.

How to calculate the average annual return

How to calculate the average annual return

The assets can be held for several years. Moreover, most assets do not grow by the same amount. Assets such as stocks can fall or rise by tens or hundreds of percent per year. Therefore, I want to know how much your investments have grown on average per year. How do you calculate the average annualized return? The average annual return is calculated by root extraction using the formula:

Formula 1

where n is the number of years the asset has been owned.

An example of calculating the profitability if we owned a share for 3 years:

3√125/100 — 1 ∗ 100% = 7,72%

Formula 2

Another formula for calculating the average annual return is through exponentiation.

The return on this formula is very easy to calculate in Ecxel. To do this, select the DEGREE function, in the Number line enter the quotient of division 125/100, in the Degree line enter 1 / n, where instead of n specify the number of years, add -1 outside the brackets.

In a cell, the formula will look like this \u003d DEGREE (125/100; 1/3) -1... To convert a number to a percentage, select the "Percentage" cell format.

In a cell, the formula will look like this \u003d DEGREE (125/100; 1/3) -1... To convert a number to a percentage, select the "Percentage" cell format.

How to calculate the average annual return if the annual returns are known?

If you know the return on the asset by years, then the average annual return can be calculated by multiplying the annual returns and extract from the product a root equal to the number of years.

First, convert the percentages to numbers.

For example, the first year is + 20%, the second year is -10%, the third year is + 30%. In numbers it will be like this: 1.2, 0.9, 1.3. The yield is 3√1.2 * 0.9 * 1.3 - 1 * 100% \u003d 11.9%.

These formulas take into account the effect of compound interest. The simple formula for calculating the yield does not take this into account and overestimates the yield, which is not entirely correct.

Now you can calculate the profitability of your investments not only as a percentage per annum, but also on average over several years. Next time I will write how it is correct and very simple.

Elena Pazina

Updated: 2019.07.08

Font A A

One of the indicators of a country's economic health is the well-being of the middle class. It is its representatives who provide the lion's share of income from the sale of cars, real estate, and retail. The middle class has been actively developing in our country for the last thirty years. World practice shows that additional sources of income are very popular among its representatives, including investment income. Citizens become rentiers, open bank deposits, invest in securities. The editors have collected information about the methods of passive earnings, structure, features.

Investment characteristics

Among domestic economists, as it turned out, there is no agreement on a clear definition of the concept of "investment". Most often, the word "investment" is used when it comes to a long-term investment of money in order to make a profit in a few years or have an annual income for a long time.

Accordingly, investment income is a profit obtained with the help of funds withdrawn from their current turnover, invested in any direction in order to obtain additional income.

Examples of sources of passive income are given by Gleb Zadoya:

There are three types of investments that can bring profit:

- real - money is invested in tangible (real estate, equipment, goods, etc.) or intangible (licenses, patents, and so on) assets;

- financial - buying securities, opening deposits, etc.

- intellectual or intangible - investments in objects of intellectual, cultural property.

Investment classification

The return on investment is called total investment income.

Its structure is formed by two components:

- current profit - payments of interest, dividends, etc.

- capital gain or exchange rate income - an increase in the initial investment.

When planning investments, one must remember that not only profit is possible, but also losses. This applies not only to the reduction in the amount of dividends, the lack of interest payments, but also to the reduction in the value of invested funds.

For example, 1000 shares were bought for 100 rubles. The invested capital amounted to 100,000 rubles. In two years, the value of the securities fell to 90,000 rubles. This means that the investor, despite the payment of dividends, incurred losses.

Gleb Zadoya briefly compared the types of investment in his video:

Income from investing money must exceed the inflation rate, only in this case the investment is profitable.

Types of investment income

There are three main classifications of types of investment income. The first is based on the types of investments made, the second on the duration of the investment, and the third on the regularity of payments.

Classification by type of attachment:

1. Real investments bring profit in the form:

- an increase in the market value of investment objects;

- rent;

- income from production, which imply not only the sale of any goods, but also the shares of the enterprise.

2. Financial investments allow you to make money on:

- interest payments, for example, on loans, bonds, deposits;

- dividends;

- growth of quotations.

3. Intangible investments pay off thanks to:

- various license fees or royalties;

- profits from the development of innovative technologies and industries.

When investing in the development of innovative industries, profit can be in the form of intangible assets, such as access to free use of technology and so on.

Profit from investing money can be obtained:

- Quickly. Short-term investments lasting from a few minutes to weeks, which are associated with a high risk of loss.

- In a few weeks, months, with medium-term investments in mutual funds, banks, and so on.

- With long-term investments, investment income comes in a few years (more than three).

In terms of the frequency and type of payments, the investment income consists of:

- regular dividends (percent);

- capital growth;

- total profit combining both options.

Knowing the various ways of making a profit from investing money, the investor selects the most suitable option for himself.

Someone prefers to develop production in order to get a stable operating business that brings dividends in 5-10 years. And someone - to speculate in the market Forex by receiving monthly payments.

When choosing an option for investing money, it is worth considering not only the available amount of free funds, but also the personal characteristics of the future investor.

Maximum return on investment is associated with a huge risk of loss. The more reliable the investment, the lower the profit.

So the interest rate on ruble bank deposits is 7-9% per annum, but the amount up to 1,400,000 is protected by state insurance. Payments in mutual funds reach 30%, but there is a risk of losing investments.

Investment income taxes

Property tax

Investment income is taxed at the standard rate for personal income tax - 13%, but there are small nuances.

Taxation scheme for real estate investments:

Investment tax

Tax deduction

For investments in securities:

For owners of individual investment accounts, there is an opportunity to receive a 13% tax deduction:

Investor incentives

For investors who invest in the development of production, the creation of new technologies, state and regional preferential programs are provided.

Here is an example of tax incentives for investors in the Novosibirsk region:

The declaration is submitted annually by April 30 to the regional inspection at the place of registration. The video will help to understand the general issues of budget payments:

It is necessary to clarify tax rates, specifics of filling, with the inspectors. The fact is that in the inspectorates of different cities and regions of the Russian Federation, points of view on paying taxes differ, much is regulated by internal instructions.

Regardless of the amount of money invested, you can always choose an instrument that guarantees a stable investment income. The main thing is to study the issue and pay taxes on time.

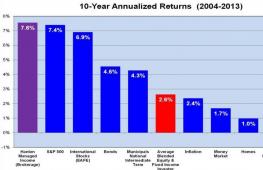

Analysts of CB Renaissance Credit compared the profitability of the main investment instruments that Russians most often use for the period from 2011 to 2015. As a result, the absolute leader was dollar bank deposits... Their aggregate profitability over five years, expressed in rubles, was 209%. This indicator is due to the large-scale depreciation of the ruble that occurred in 2014-2015. According to the authors of the study, the success of using dollar deposits depends, first of all, on the investor's ability to predict the dynamics of the exchange rate and on his willingness to invest for a long time.

Ruble bank deposits would have made it possible to earn about 4 times less over the past five years - about 49.5%. However, in comparison with dollar deposits, this instrument has a more stable profitability. The authors of the study believe that it is also the most affordable and safe asset, since it does not require large investments and is insured by the state for 1.4 million rubles. There is also a tool that combines the best characteristics of both types of deposits - a multi-currency basket of deposits, experts say. Based on the results of five years, this investment strategy would have earned at least 129%.

Quite high profitability was shown by golddespite the fact that after the end of the global financial crisis of 2008-2009, prices for this metal are gradually decreasing. In 2012-2013, investments in gold would have brought only losses, but already in 2014 the precious metal confirmed its status as a defensive asset in the Russian financial market. As a result, its profitability for 5 years was 86%. Analysts warn that the success of investing in gold, as in the case of foreign currency deposits, depends on the ability to predict the future dynamics of the markets and the willingness to invest for a long time.

The property in five years would bring the investor 73%. With the exception of 2015, when investments in this asset were unprofitable, real estate showed relatively stable growth in profitability. Experts believe that the main disadvantages of this investment strategy are the high requirements for the initial capital and the low return on investment in the apartment.

Mutual funds turned out to be the least stable instrument in terms of profitability. In 2014, this asset was unprofitable, but already in 2015 it came out on top, allowing investors to earn 23.8%. Nevertheless, based on the results of five years, mutual funds would bring the lowest income in comparison with other instruments - about 14%. Experts note that the study considered the simplest strategy for investing in mutual funds, which involves investing in funds that have shown the maximum return in the past. By choosing a more complex strategy, an investor could earn more, but this requires special skills and knowledge, as well as an understanding of the situation on the stock market.

Sergey Suverov, head of the analytical department of the Russian Standard Management Company, believes that this year one should not hope for high yields on bank deposits. “The trend towards the strengthening of the ruble and low interest rates on deposits will hardly make it possible to make good money on dollar deposits, and ruble deposits will not be able to show a decent profitability due to high inflation,” the analyst says.

According to Suverov, a real alternative to bank deposits in 2016 could be individual investment accounts (IIA), OFZ and equity mutual funds. “IIS is a long-term instrument for which, moreover, you can get a tax deduction. Money from this account can be invested in stock market instruments and in debt securities - for example, in the same OFZ. By the way, it is worth paying attention to government bonds, because in the long term, the Central Bank will reduce the key rate. Equity mutual funds are interesting because the securities market will grow as oil prices recover, ”Suverov commented.

Analyst of Alfa-Capital Management Company Andrey Shenk believes that the main competitors of deposits in the next few years are debt instruments, which will grow in price as inflation slows down and the Central Bank's rate decreases. “The yields of many OFZ issues are already at the level of 9.2-9.3%. Considering that now there is a tendency for inflation to slow down and the market expects the Central Bank to cut the key rate, these issues will still be revalued. The demand for government bonds will grow. Corporate bonds of the first echelon are also very interesting. The yield of some securities from this segment of the debt market is already higher than the rates on deposits, ”said the financier.

- - The only one with a license from the Central Bank of the Russian Federation. invested $ 20,000

- - The best. Has been working since 1998. invested $ 20,000

- - This is a Swiss bank with access to Forex! 18 000 $

- - I have been working with him since 2007.invested $ 10,000

- - They give 1500 USD as a bonus. invested $ 10,000

- - the best cent account. invested $ 8000

- - For scalping, only he AND EVERYTHING! 8000 $

- - $ 30 GIVE ALL NEW! invested 5000 $

- - $ 30 GIVE ALL NEW! invested 5000 $

- - THIS IS NeftepromBank. invested 5000 $

- - I use it as binaries via MT4. Invested 5000 $

But already how to make money, we discuss everything in a closed group, more precisely in secret Forex forum ! There are a lot of traders, financial bloggers, brokers and newbies! We discuss what works and what doesn't! Join, the more of us, the easier! See an example of personal earnings

In the broad sense of the word, income is the receipt of monetary or other material values \u200b\u200bin the process of carrying out any activity.

but investor income in the broadest sense of the word, it can be formed not only from material values, but also from intangible ones.

Investor income from direct investments

When, the investor's income consists of two main parts. Financial and material.

In the form of a financial part, this is money received by an investor as a result of the sale of his stake in the company to a potential strategic investor, co-owner of the company or the sale of the company on the stock market as a result of an IPO.

In the material part, investor income there may be ownership rights to movable and immovable property, equipment, licenses and patents.

Investor income from financial investments

When making financial investments, investor income is calculated based on the risk-free rate.

In the Russian Federation, this rate is now at the level of 8 percent per annum, this is a guaranteed minimum percentage of an investor's income on the securities market.

When financial investments in bonds, companies attract private investors at a slightly more attractive interest rate of return, namely from 10 to 15 percent per annum.

Thus, companies encourage the investor to invest not in risk-free bonds, but in bonds of other issuing companies.

With shares of various companies, investor income is formed based on the financial results of the company, in other words, based on its profit. This is because shares give shareholders the right to participate in the distribution of profits.

That is, the more successful the company ended the current financial year, the more its profit, the more investor income .