Tangible and intangible assets. Intangible and tangible assets Tangible production assets

Enterprise assets- a set of property rights belonging to the enterprise in the form of fixed assets, stocks, financial contributions, monetary claims against other individuals and legal entities. In other words: assets are investments and claims. The term "assets" is also used to refer to any property, property of the organization.

Assets are usually divided into tangible and intangible. Intangible assets include non-monetary assets that do not have physical form and meet the following conditions:

Look at Excel spreadsheet

Bankruptcy risk assessment

Intangible assets can include the organization's business reputation (goodwill) and intellectual property. In turn, objects of intellectual property (exclusive right to the results of intellectual activity) include:

- The exclusive right of the patent holder to an invention, industrial design, utility model.

- Exclusive copyright for computer programs and databases.

- Property right of the author or other copyright holder.

- The owner's exclusive right to a trademark and service mark, appellation of origin of goods.

- The exclusive right of the patentee to selection achievements.

Asset liquidity and asset structure

Assets are grouped according to their degree of liquidity (ability to be sold at a price close to the market price): highly liquid, medium liquid, low liquid and illiquid assets. The most highly liquid asset is cash on hand and in current accounts. Cm. The structure of assets by liquidity groups.

The ratio of assets and liabilities of an organization determines its financial condition, and in particular, solvency. There is a methodology for assessing the financial condition of an enterprise by financial ratios, the most important of which are calculated based on the size of assets and the degree of their liquidity.

Reflection of assets of the enterprise in accounting

Assets in accounting are reflected in the asset (on the left side) of the balance sheet.

Other non-current assets in the balance sheet are

The current form of the balance sheet in the Russian Federation includes two sections of assets: current and non-current assets:

- Current assets (current assets) are used in the course of day-to-day business activities. For example: inventories, accounts receivable, cash.

- Non-current assets are assets withdrawn from economic circulation, but reflected in the accounting records. For example: fixed assets, intangible assets, long-term investments.

Look at Excel spreadsheet

"Analysis of financial condition"

70 odds, dynamics for 8 periods

Bankruptcy risk assessment

Enterprise assets are economic resources controlled by the entity. The assets of an enterprise are the totality of property and funds belonging to the enterprise, firm, company, in which the funds of the owners and owners are invested.

Assets are formed from the capital invested in them; characterized by deterministic cost, performance and the ability to generate income. Constant turnover of assets in the process of their use is associated with the time factor, risk and liquidity.

The assets of the enterprise include:

- property of a legal entity (enterprise), which has a monetary value;

- property of a legal entity and attracted funds;

- securities;

- inventory items;

- fixed assets;

- financial investments in enterprises of other entities;

- own patents;

- inventions;

- "know-how";

- rights to use land and natural resources;

- any other property of an economic entity (enterprise, firm, company, etc.) that can be used to carry out entrepreneurial activities.

Distinguish tangible assets,assetsintangible, as well as financial assets (fig. 4.1).

Tangible assets - this is the property of legal entities or individuals, which has material form and monetary value.

Tangible assets

- land owned;

- buildings and structures for industrial and non-industrial purposes;

- administrative buildings;

- non-industrial facilities on the balance of the enterprise (residential buildings, educational, children's, medical, health, sports and other institutions, premises that are on the balance of the enterprise);

- installed and uninstalled production equipment;

- non-production movable property;

- stocks of raw materials, fuel, semi-finished products (in warehouses, in workshops and on the way), finished products;

- property, fixed assets, leased land plots that belong to the enterprise; branches; subsidiaries, if they do not have the status of a legal entity, and their balance sheets are not split from the balance sheet of the parent company.

Tangible assets are subdivided into reproducible (inventories, fixed assets, material and artistic values) and irreproducible(earth, bowels).

In addition to the material resources of the enterprise, which include fixed assets and working capital, the effectiveness of its activities depends on the availability and degree of use of intangible resources.

TO intangible resources include those resources that do not have a material basis, but are able to bring profit or benefit to the enterprise (firm) for quite a long time. The main feature of such resources is the lack of the ability to determine the overall size of the benefits they bring.

Intangible assets - the notional value of objects of industrial and intellectual property, other similar property rights recognized as the object of property rights of a particular individual or legal entity, which bring him income.

Intangible assets- these are assets that have no material and material structure, a new category in the composition of the property of the enterprise.

Key features of intangible assets:

- lack of material and material (physical) structure;

- use for a long time;

- the ability to benefit the enterprise;

- a high degree of uncertainty about the size of the possible future profit from their use.

All intangible resources are divided into industrial and intellectual property.

TO objects of industrial property relate:

- inventions;

- industrial designs;

- rationalization proposals;

- know-how;

- trademarks and trademarks;

- goodwill.

Invention is called a fundamentally new technical solution to the existing production problem, which gives a positive effect for the field of the national economy.

Industrial design is the model of the product developed by the author or the team of authors, which will be produced at this enterprise. An industrial design can be volumetric, flat (drawing) or combined and is intended for demonstration of products at presentations and exhibitions. A sample is considered new if the totality of the properties of a new product is not known in any of the countries to fix its priority.

Rationalization proposal - this is a useful recommendation regarding equipment and technology used in a particular enterprise. Unlike inventions, it may already be known at other enterprises or in the fields of the national economy, but at this enterprise it is used for the first time: it is an improvement in the used technology, manufactured products, methods of control, observation and research; improved safety measures; increasing labor productivity, efficiency in the use of energy, materials, etc.

Know-how (“Know how to do it”) is certain knowledge and experience of an enterprise in any area of \u200b\u200bits activity: scientific and technical, production, management, commercial, financial, for which the enterprise has spent significant funds. The know-how is not protected by title of protection, but is not disclosed.

Trademarks and Trademarks - these are original symbols that distinguish the product of this company from the products of competitors.

Goodwill it is the formed image of the company, the components of which are experience, business relations, prestige of trademarks, constant clientele, benevolence and favor of consumers, etc.

To objects of intellectual property relate:

- information activities related to the receipt of information materials, their processing, storage, use and distribution;

- software - characterized by a set of software, organizational and technical means intended for the centralized accumulation and use of information;

- Database;

- knowledge base, as well as works of literature and art.

The rights to use objects of industrial and intellectual property are called intangible assets enterprises. Certain elements of intangible assets have legal protection in the form of a patent and copyright.

Patent -this is a document issued by the state (state body) to a person or enterprise with the granting of the exclusive right to use the invention or rationalization proposal specified in the patent. The patentee creates a monopoly on industrial or other commercial use of intangible resources and, if necessary, can prohibit anyone from using them without specific permission.

Either the owner himself, or a trusted person, or an enterprise can exercise ownership rights to intangible resources.

Permission to use intangible resources is called license... It provides that the user (licensee) will use industrial or intellectual property objects for the period specified in the license and will pay a fee to the owner (licensor).

Such remuneration can be paid in the form of established certain rates to the volume of net sales, the cost of production, to the cost of a unit of licensed products (royalties) or as a one-time payment for the entire period of use (lump-sum payment). In fact, the lump-sum payment is the license fee.

Financial assets - these are funds of individuals or legal entities in objects from which profit is expected in the future:

- cash on hand;

- deposits in banks;

- contributions;

- insurance policies;

- investments in securities;

- consumer credit;

- shares of other enterprises that give the right to control;

- specific assets (monetary gold and special drawing rights).

This site was created using Okis. Create your own for FREE.

The problem of objectively assessing the value of companies' assets in the current economic situation is becoming more and more urgent, since:

- the value of assets is the initial information for the development of a strategy and tactics for the implementation of the operating activities of any enterprise, as well as the subsequent monitoring of the implementation of the goals and objectives, their adaptation to changing conditions;

- the value of assets serves as the basis for obtaining reliable information about the financial position of the company and the results of its activities, as well as their analysis;

- objective data on the assets of the country's enterprises (broken down by industry) are needed by government bodies when developing directions for balanced strategic development of the economy and meeting the country's needs that guarantee its national security, as well as when implementing the adopted economic policy;

- adequate asset value creates the prerequisites for maintaining the stability of the banking system, since assets often act as collateral when obtaining a loan.

In the conditions of the crisis and in the post-crisis period, the issues under consideration acquire special significance due to the fact that:

- first, for the majority of national enterprises, the value of their assets has dropped sharply over the past stage of crisis processes;

- secondly, this decrease in most cases was not reflected in their official reporting.

At the same time, the value of assets is an indicator of the prospects for the development of an enterprise in the post-crisis period. Obviously, an objective valuation of assets will allow proactive measures to be taken to minimize the negative consequences of possible situations of an ongoing crisis and to maximize future potential benefits.

Of all the assets, intangibles are the most difficult objects of research. It should be noted that global trends indicate the ever-growing influence of intangible assets on the value of companies. Over the past 20-30 years, intangible assets have become the main asset class of large corporations. Currently, the value of companies is no longer viewed as a set of tangible assets - the share price reflects the significance and value of all intangible assets, including objects of patent rights, trademarks, copyrights, etc.

To recognize intangible assets as an asset, it must have a number of characteristics.

Possibility of accurate identification and availability of a specific and recognizable description.Unlike, for example, real estate objects, intangible assets, of course, cannot always be described using actual boundaries and parameters. But at the same time, intangible assets must have a clear and fairly simple definition that distinguishes it as a unique object.

Legal recognition and the ability to provide legal protection. In most cases, the ability to control an asset implies the existence of legal rights to use intangible assets. It is by the control criterion that intangible assets can be distinguished from intangible resources. The latter may include the qualifications of personnel, customer loyalty, market share, etc., however, as a rule, the company cannot demonstrate the possibility of obtaining economic benefits from the use of these resources, since it is unlikely to be able to control the action of such external factors as the behavior of personnel, the reaction of competitors and buyers.

Material evidence or evidence of its existence (contract, customer list, registration certificate, etc.). This requirement does not affect the economic value of intangible assets (for example, the absence of formal documentation on know-how does not mean that its owner cannot receive any benefits from its use), however, it is a prerequisite for its existence as an identifiable object.

The ability to accurately establish the date of its origin or creation. Despite the fact that intangible assets, like other types of assets, can be created or developed over a long period of time, each such asset must have a well-defined date of creation (for example, the date of signing a contract, issuing a patent).

Termination of existence at an identifiable point in time or as a result of a specific event. The requirement to determine the life of intangible assets does not mean that a specific date of termination of its existence must be set, although for many intangible assets this is possible (for example, the expiration of a contract or patent).

When assessing intangible assets, it is necessary to take into account that they often have an extremely narrow scope, and this significantly limits their ability to generate income, since intangible assets are often created by the company itself, and not purchased on the market. However, this does not mean at all that they can be easily recreated. The uniqueness of each intangible asset and the absence of an active market for such assets significantly complicate the selection of analogues for them, in contrast to tangible assets.

Taking into account Russian valuation practice, intangible assets can be classified into the following main categories:

- technological (inventions, utility models, industrial designs, production secrets (know-how), topology of integrated circuits, design and technical documentation, technical specifications, teaching materials);

- marketing (trademarks and domain names);

- contractual (license agreements, franchising agreements);

- Intangible assets related to data processing (database software).

Each of the above categories of intangible assets is characterized by its own set of factors affecting their value, in particular: absolute / relative age, versatility, expansion potential, commercialization costs, means of commercialization, specificity (industry of application / use), geography of use, market share , competition, projected demand, associations.

Of course, not all of the above factors are applicable to every category of intangible assets and not all of them have the same impact on their economic value. In addition, it should be noted that for each individual factor there is a wide range (both quantitative and qualitative) of possible positive and negative impacts on the value of a particular type of intangible assets.

At the same time, there are parameters common to all intangible assets that have the most significant impact on their value, namely: the life of the asset, the possibility of reproduction / reconstruction of the asset, restrictions on use and the stage of development / use.

Speaking of tangible assets, amid the economic crisis, many experts in the commercial real estate market come to the conclusion that there is no such thing as “market value”.

In accordance with FSO No. 2, the market value of the appraised object is understood as the most probable price at which this appraisal object can be alienated on the open market in a competitive environment, when the parties to the transaction act reasonably, having all the necessary information, and the value of the transaction price is not reflected any extraordinary circumstances. However, in the current crisis conditions, most transactions have to be made “in a forced manner”, when real estate objects are transferred within the framework of debt restructuring to creditor banks or are forced to be sold in search of the necessary funds at a significant discount.

Among the most common factors that characterize the commercial real estate market in the "era of crisis", one can single out: a decline in demand for rent and sale, a significant decline in offer prices and rental rates, as well as the bankruptcy of many developers.

As a rule, in such a situation, the number of transactions is minimal. The main structure of demand is made up of high-class office properties (classes "A" and "B"), business-class residential premises, as well as development projects offered at a large discount, moreover, many objects are not exhibited on the open market.

During the crisis, a relatively new concept appeared on the commercial real estate market - “problem assets”, which is often used in the current crisis conditions. In general, these assets include items that can be purchased at a materially reduced cost or with debt. The key features of problem assets are: a high level of vacant space, significantly reduced rental rates relative to the existing market ones, low operating income, and significant loans from anchor tenants. The main reason for the emergence of problem assets is the lack of resources for owners / investors to maintain the property in good condition.

Over a fairly long period in Russia, there was a noticeable growth in the stock market, accompanied by an increase in the value of tangible and intangible assets on the balance sheet of organizations. The deterioration of the economic situation in Russia due to a sharp decline in world prices for energy resources, the sale of which makes up a significant part of Russia's budget revenues, as well as the introduction of economic sanctions against the Russian Federation, caused a significant depreciation of the ruble against foreign currencies, an increase in inflation, a decrease in real incomes of the population and a significant deterioration in the situation in a number of sectors of the Russian economy.

A decline in the purchasing power of the population and a lack of funds at enterprises, unpredictable dynamics of raw materials prices, deterioration of macroeconomic indicators and a number of other factors have called into question the size and stability of future cash flows, as a result of which companies are forced to adjust their development forecasts.

Negative trends of pessimistic forecasts can be observed when analyzing the financial statements of Russian companies that have published statements in accordance with International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Regulations (GAAP) of the United States. Thus, a significant part of companies recognized the impairment of assets such as property, plant and equipment, goodwill, and other intangible assets in their statements for 2013 and 2014.

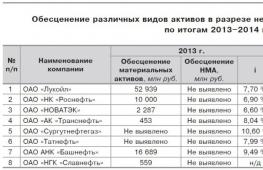

Within the framework of this article, the impairment of various types of assets of the largest companies in the oil and gas sector, tangible assets in the structure of the balance sheet of which occupy a significant share, as well as assets of enterprises in the financial sector are considered. The specificity of the latter lies in the fact that the main asset of such companies is not fixed assets and intangible assets, but issued loans, the risk of impairment of which is quite high, and the size in monetary terms exceeds the size of fixed assets of companies in other sectors of the economy.

If we talk about the number of companies that recognized impairment of assets in the reporting for 2014, the following can be noted:

- Of the studied 8 public companies in the oil and gas and financial sectors of the economy, 4 and 7 companies, respectively, recognized asset impairment in 2014, which is about 50 and 88% of the total sample.

- The largest share of impairment recognized by oil and gas companies is attributable to tangible assets, in particular, fixed assets and assets for sale, due to negative changes in the economic situation and a sharp decline in oil prices.

- Companies in the financial sector are more likely to experience impairment of intangible assets in the form of goodwill / goodwill, which is explained by the negative impact of the current macroeconomic situation on the development business.

It is important to note that, despite the increase in the level of disclosure, there is still a small number of companies (on average 25% of companies from the sample presented) that do not disclose information on discount rates. In addition, many organizations do not pay much attention to such information.

When disclosing information about the discount rate used, most companies do not indicate the type of rate and characteristics of the cash flow: whether the discount rate is used for pre-tax or post-tax flows, in nominal or real terms, in what currency the projected cash flows are expressed.

When comparing the discount rates used for the period from 2013 to 2014, the following assumptions were made: firstly, if the reporting does not contain the weighted average cost of capital for the company as a whole, then the rate specified for a specific division, or the average of specified rates; second, unless otherwise indicated, it is assumed that the rate is pre-tax, nominal and denominated in the currency of the report.

Analysis in terms of disclosure of discount rates shows that the average value of the applied discount rates has increased. The average cost of capital in 2013 for enterprises in the oil and gas and financial sectors of the economy was 8.19% and 11.62%, respectively, in 2014 it increased to 12% and 16%, respectively. In the oil and gas sector, there has been a significant increase in the number of companies applying a discount rate of over 12%. The increase in the cost of capital is due to the deterioration of the macroeconomic situation - increased risks and borrowing rates.

The existing financial and economic crisis has led to a significant impairment of various types of assets: fixed assets, goodwill and other intangible assets, investment / securities, etc.

A significant part of the factors affecting the depreciation of assets refers to environmental factors that are not controlled by companies for objective reasons, in this regard, in order to improve the comparability of reporting data from period to period, increase its transparency and make the right management / investment decisions, companies need to regularly test for impairment of assets.

The tangible assets of a company are that part of its own resources, which has a material and property form. Such objects have a monetary value, are used repeatedly in activities or are intended to be sold unchanged. For example, these are buildings, sites, structures, working machines / equipment, inventory, transport, refineries, finished products and other objects. Let's consider in detail the regulatory features of accounting for tangible assets and typical transactions for reflecting transactions.

What belongs to tangible assets

It is customary to divide the property assets of an organization into 2 main groups - non-current (VOA) and circulating. The first include objects that are withdrawn from the company's turnover in order to achieve the specified goals of activity. The second includes those resources that complete a full cycle during the reporting period of 1 calendar year and participate in daily activities.

Grouping of non-current assets:

- Fixed assets - buildings for production / non-production purposes; land and land rights; administrative buildings; production equipment, including not put into operation; vehicles, etc. Includes rental properties.

- Material prospecting objects - according to PBU 24/2011, such assets include various structures, equipment and transport used in the search and / or development of natural resources. For example, these are drilling rigs, pipelines.

- Investments in tangible projects - includes tangible resources provided to other organizations for a fee in temporary possession. These are lease, rental and leasing agreements.

- Other types of SAI.

Grouping of current assets:

- Inventories - raw materials, fuel, semi-finished products, materials, goods, finished products, work in progress.

- Other types of assets.

All types of tangible assets of the enterprise are subject to reflection in the financial statements for a given date with the disclosure of the coding by item. The value expression is formed on the basis of the accepted methods for assessing MA upon entry and exit.

Note! Does not apply to tangible assets of intangible assets, financial investments of a long-term / short-term nature, cash resources and equivalents, securities, accounts receivable.

Accounting for tangible assets

The accounting of property objects of the enterprise is carried out by reflecting business transactions on work accounts. The main ones include - accounts from 01 to 26, 40, 41, 45, 29, 44. Accounting for inventories is made in accordance with PBU 5/01, fixed assets - in accordance with PBU 6/01. The procedure for the formation of transactions and the value expression are determined in accordance with Order No. 34n dated July 29, 1998. At the same time, the rules for assessing various types of material resources are regulated in detail by clause 23 of the Order:

- For objects received for a fee - the cost is the sum of all actual costs.

- For gratuitously received objects - the property is evaluated based on market prices at the time of posting.

- For the objects manufactured by the company - the cost of the issue is taken into account.

Attention! The company has the right to use other valuation methods, including the reservation method, if it is provided by the legislation of the Russian Federation.

Tangible assets in the balance sheet are reflected in the corresponding lines at the reporting date:

- P. 1140 - material search objects.

- P. 1150 - items of fixed assets.

- P. 1160 - investments in material assets.

- P. 1190 - other types of HEIs.

- P. 1210 - goods and materials and stocks.

- P. 1260 - other types of OA.

The main typical transactions for the accounting of tangible assets:

|

Business operation |

Debit |

Credit |

|

Equipment purchased for a fee |

||

|

Highlighted in the value of the fixed asset VAT |

||

|

Reflected the initial cost of the equipment received |

||

|

Received at the warehouse of the enterprise |

||

|

Highlighted VAT |

||

|

Depreciation accrued on equipment |

20, 44, 23, 25, 29, 26 |

|

|

Reflected expenses for modernization of the fixed asset |

||

|

Implemented the sale of the fixed asset, separately allocated the amount of VAT |

||

|

The write-off of accrued depreciation is reflected |

||

|

The write-off of the residual value of the sold fixed asset is reflected |

Enterprise assets

From a business perspective, assets are assets that can generate income. At the enterprise, these are: buildings, equipment, raw materials in warehouses, money in accounts, vehicles and much more. In the company's balance sheet, their value is indicated in the asset. The liabilities contain the sources of this property formation: bank loans, authorized capital, borrowings, and the like.

The assets of the enterprise are divided into groups based on the methods of valuation.

Tangible, intangible and financial assets

By form, assets are divided into tangible, intangible and financial. Tangible assets are physical property: equipment, fuel, furniture, buildings, tools, and so on.

Intangible assets are intangible, but have value and economic value. For example:

- patents, trademarks, intellectual property rights;

- the right to use subsoil;

- licenses and permits;

- formulas, software products, technologies and other similar inventory items.

Financial assets are money and cash equivalents such as deposits in accounts with financial institutions, loans issued, shares and bonds of other organizations.

The firm uses all types of property. At the same time, the role of the intangible component has increased due to the influence of information technology and information in general on business success. The more intangible assets a company uses, the more high-tech product it produces.

Current and non-current assets

Depending on the turnover and the nature of participation in business processes, assets are divided into current and non-current.

The first include those types of property that are fully used during one production or commercial cycle. A striking example of current assets is raw materials for production, which, after processing, turn into a finished and by-product. Current assets also include money in the company's account, which is used to pay salaries to employees, purchase raw materials and materials, payments for financial obligations, and so on.

Non-current assets do not change shape and are not consumables. They work over several production cycles, gradually transferring the cost to the finished product. One of the types of non-current assets is fixed assets. These are the assets that ensure the production process for a long time:

- buildings and structures;

- cars and other mobile equipment;

- production equipment;

- expensive and used for a long time tool, inventory and the like.

Non-current also includes most intangible assets, long-term loans (issued), equipment leased out, securities, deposits and other financial instruments.

Production and non-production assets

If we are talking about an industrial enterprise, then part of the property is directly involved in the production process. These are, for example, a workshop building, a technological line, equipment used in production, fuel, raw materials, tools and other similar values. At the same time, such a company has an administrative building and service divisions.

Anything that does not take physical part in the production process is called non-productive assets. These include office appliances and furniture, cars, industrial canteen or laundry property.

This division of assets is used to calculate direct and indirect costs. The cost of production values \u200b\u200bcan be easily transferred to finished products, since they are consumed directly in the manufacturing process. For costing non-productive assets, overhead formulas are used and then transferred to the cost of finished goods.

Own and borrowed assets

In the course of work, the company can use both purchased property and rented property. Assets bought with the company's money are called own. The assets raised are leased property and cash loans, including leasing.

The assets raised are inextricably linked with liabilities. The company needs to pay off loans, pay rent and service debt securities. If we talk about lease with subsequent purchase, then after the company pays off its obligations to the lessor, the property goes from the category of attracted assets to its own.

Other types of assets

When evaluating assets, they are also divided depending on liquidity:

- absolutely liquid (money);

- highly liquid (short-term receivables and deposits with a short repayment period);

- medium-liquid (finished products, goods, accounts receivable);

- weakly liquid (financial instruments with a long maturity, some types of intangible and non-current assets);

- illiquid (bad accounts receivable, marriage, loss).

Based on the sources of formation, use the concepts of "gross assets" and "net assets". All types of property are classified as gross, regardless of what funds they were purchased with.

Net assets were purchased with the company's personal not borrowed funds. To calculate the value of net assets, the amount of liabilities is subtracted from the total assets of the enterprise. This indicator characterizes the financial independence of the company and is calculated according to the balance sheet data. It displays the real amount of the organization's own funds.

Understanding the classification of assets and their characteristics allows a detailed and thorough assessment of the activities of a commercial organization in specific economic indicators. Based on the data of such analysis, management decisions are made, including those regarding the further development of the business.

We cited the classification of assets on various grounds and noted that in terms of materiality, assets are tangible, intangible, etc. In this article, we will dwell in more detail on the material assets of the enterprise.

Accounting for tangible assets

Tangible assets - part of the property of an organization, which has a tangible form and does not belong to financial assets. The most common types of tangible assets of an organization are fixed assets, finished products, goods, materials.

The accounting of tangible assets is maintained on the following main synthetic accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

- 01 "Fixed assets";

- 03 "Profitable investments in material assets";

- 08 "Investments in non-current assets";

- 10 "Materials";

- 41 "Products";

- 43 "Finished goods".

Thus, the initial cost of an object of tangible assets acquired for a fee is generally determined by summing up the actual costs incurred for its purchase; received free of charge - at market value on the date of posting; property produced in the organization itself - at the cost of its manufacture.

Tangible assets in the balance sheet

Objects of tangible assets can be reflected in the balance sheet of the organization in the following lines (