What is return on investment. Investor income. Investment or speculation

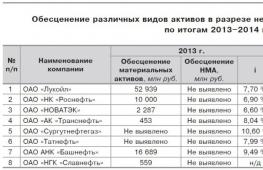

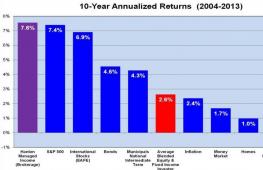

Speaking in previous articles that passive investing usually wins over active investing - and also mentioning that more than 80% of hedge funds lose to passive investors - I have not yet written in numbers what kind of investor return is in question. So in this article we will talk about investment income. Below is a table of the profitability of American investors in the period 2004-2013 (i.e., taking into account the global crisis of 2008):

So, we see that passive investing in the American market (S & P500 index) has brought an average of 7.4% per annum over these years. Shares of global companies came close to this result, which gave an average of 6.9%. Bonds in this segment lost almost two times, giving 4.6% per annum. And only then, with a noticeably lower result, the investor's income comes - only 2.6%. And the most interesting thing is that according to the rating calculation method, this is not net profitability, but taking into account the positions (equity) that were not closed at the time of collecting statistics. For example, it could be a purchased futures, the expiration of which occurred at a later date than the statistics were collected.

If we take the fully fixed income, then it turns out to be at all at the level of 0.6% - i.e. such investment income is even inferior to inflation! Moreover, according to statistics, not since 2004, but since 1993, the difference will increase even more - shares of the American market gave an average of 8.2% during this period, and the average investor's income was 2.3% (gold profitability was due to a sharp rise in 2001-2011 - however, in fact gold is a commodity that differs little from, for example, wheat. According to Buffett, gold does not produce anything, although it still has its merits).

At the same time, passive investment in the American market would yield results as in the table below. Those. a closer look shows that the return on investment over a 10-year period over a distance of 80 years could range from -1.2% to 18.30%. Investment return over a 20-year period - from 2.60% to 17.40% respectively instead of the 8.2% indicated in the table above. To stabilize the results (no one wants to be at least a small loss after 10 years, adding to it losses from inflation), the investment portfolio serves.

Investment or speculation?

But why does the average investor lose about four times to the market result (10.5% per annum)? I will try to highlight a number of reasons.

Excessive self-confidence

Such an investor (in fact, a speculator) is confident in his knowledge and believes that he will be able to predict, if not all, then the main ups and downs of the market or the selected securities. Maybe he trusts technical analysis, or maybe he actively follows the stock market news on the Internet or on TV. But the end result in most cases turns against the investor and in the long term consists of the ballast of spent commissions for operations and incorrect decisions. Of which, as a rule, there are more than faithful. According to various studies ( Do Individual Day Traders Make Money? May 2004; The Cross Section of Speculator Skill Evidence from Day Trading, May 2011), no more than 15% of intraday traders make a profit per year - and almost none of those who were lucky could repeat the high profitability next year.

False extrapolation of data

It is human nature to draw conclusions - and try to find a pattern where it is absent. In principle, any random data set can be described by some average curve, which will not reflect the further behavior of the asset. In addition, the investor usually attaches more importance to the data for the last period. Extrapolating the continuation of growth, he risks quickly finding himself in a drawdown; extrapolating the fall may miss the opportunity to buy assets cheaply.

Loss aversion

It is known from psychology that negative events have a stronger effect on a person than positive ones. According to some estimates, to compensate for negative emotions from a market decline, you need twice as many positive ones. In fact, the average investor does not agree to tolerate a drawdown, especially a prolonged one. This often leads to a fear of investing in stocks and excessive conservatism; To overcome this helps the understanding that the value of a share is ultimately determined not by the behavior of its quotes (random and volatile in a short period), but by the value and state of the business that the issuer of the share is conducting. The company's profitability and debt, as well as its return on equity, are the fundamental factors that will lead the patient stockholder to the end result.

Variability of risk tolerance

Although today you can find different methods for determining your tolerance for acceptable capital drawdowns, it is quite obvious that this term is dependent on emotions and changes with changing market conditions. In real life, conservative investors, when the stock market rises, can buy stocks just as quickly as aggressive ones, and when the stock market drops sharply, the most aggressive investors begin to show surprising prudence and caution. Other factors that influence risk tolerance are gender and age - women and older people are more careful than their antipodes.

Below is the return on various assets since the early 70s (dividends and coupons are reinvested, commissions are not included):

The graph clearly shows that all the assets presented provided investment income above inflation, however, depending on the instrument, it fluctuated widely. So, from 1972 until the mid-80s - the crisis period in the United States - commodity assets provided noticeably better returns, and since 2000 they lagged behind American and world stocks. You can track the current movement of assets using the following table:

https://novelinvestor.com/asset-class-returns

It can be clearly seen from it that different instruments in different years appeared to be at the top and then at the bottom of the table. On average, real estate felt the best, and the S & P500 is located approximately in the midline. In the crisis years - the early 2000s with the fall of dotcoms and 2008 - bonds felt very well, in a growing market located at the bottom of the table (along with cash).

Taking the average return on investments across all instruments (including reinvestment of dividends and not including commissions), at the time of this writing, we get about 6.72% per year, which is almost equal to the average return on world stocks from 2004 to 2013. Excluding cash, the average for eight instruments will be 7.38%.

In a favorable economic situation, using high-yield bonds and low asset correlation, theoretically, you can get another 1-2% higher. Compare this with the recorded result of 0.6% per year ... of course, it should be borne in mind that in some years (for example, 2002 and 2008) the portfolio can sink quite strongly.

What to do in this case? The answer is simple: rebalance. But if you are uncomfortable with a drawdown of about 40%, then this should be taken into account at the stage of portfolio formation: the table shows that HG Bond has not sagged by more than 2% over the years. But in terms of profitability, among other instruments, HG Bond was often at the bottom of the table, confirming the rule: less risk - less profitability. So in this case, prepare for a more modest end result.

Impact of fund fees and previous leaders

When choosing funds in the paragraph above, it is important to take into account one circumstance that affects the return on investment - commissions, which for ETFs can vary from 0.05 to 1%. At first glance, the difference is insignificant, but let's look at a long distance of 30 years. With an average yield of about 8% per year, an initial amount of $ 10,000 per year and regular replenishment (by $ 5,000 per year, and this number increases by 5% annually, offsetting inflation) with a commission of 0.25% in 30 years it will be possible count on $ 533,000; with commissions of 0.9% - only for 439,000, i.e. almost $ 100,000 less (ten times the amount originally deposited).

The costs are noticeable over shorter periods. The investment profitability of all types of American stock and bond funds over 10 years (if we take the period 2003-2013) will be determined not by their composition, but by commissions - low-cost funds in all cases will give returns about 1-2% per annum higher than their counterparts. Those. the results relate to both company size (large, medium and small firms) and their types (growth, value, mixed). The same is for bonds - you can consider high-yield, short-term and medium-term bonds, as well as corporate and government type.

The industry leaders should be mentioned separately. Often, an investor - both during the initial compilation of the portfolio and in the investment process - has a desire to invest in funds that have recently shown the maximum profitability, which sometimes jumps to 20-30% per annum and even higher. These can be either passive funds in a very favorable market situation or active mutual funds. However, researchers, beginning with Sharpe (1966) and Jensen (1968), have seen very little evidence that previous returns can have any effect on future returns.

For example, Carhart (1997) announced that there was no evidence of consistently high fund returns after adjusting for Fama and French's general risk factors. In 2010, a 22-year study found that it is very difficult for an actively managed fund to regularly outperform a passive index fund. As an example, the Legg Mason Value Trust fund manager William Miller outperformed the S&P 500 fifteen (!) years in a row, until he lost all the advantage accumulated over the index in three short years.

Such managers are sometimes jokingly or sarcastically called "lucky monkeys", alluding to the famous experiment with the monkey Lukeria, who chose the controllers for throwing darts. Therefore, when investing, an investor is not recommended to focus on the current high profitability of funds (rather, on the contrary, it is more appropriate to avoid investing in them). Below is a graph from D. Bogle's book The Smart Investor's Guide:

Balance top up impact

Finally, it is very important to periodically replenish the balance, which can be done, for example, together with rebalancing. Studies have shown that an income level of $ 10,000 with an annual return of 8% and an increase in the amount of replenishment by 5% per year can achieve almost the same result as an investment rate of return of 4% with an annual increase in the amount of replenishment by 10%:

conclusions

A competent portfolio approach allows increasing profitability from 0.6% to an average of 10% per year, i.e. about 15 times. On the plus side, we get passive investing, in which the portfolio needs to be touched only once a year to restore the original balance or minor changes in the composition. The downside is the likelihood of a strong drawdown on certain periods, and therefore, you need to proceed from the freeze of the invested funds, which makes sense to withdraw only in a growing market. However, such an opportunity exists only when investing through a foreign broker - the company itself took care of the freezing in investment insurance programs.

An alternative can be a fundamental analysis of individual issuers (stocks) and investing in them - with many years of experience, you can thus receive income slightly above the market. Not much, but time for analysis and subsequent tracking of the issuer takes a lot. As a result, even consultants who are good at such a tool usually create passive portfolios for their clients, which are much easier to manage.

In order to choose the most promising among the huge number of investment options on the Internet, investors need universal evaluation criteria. The most obvious is profitability, a measure of increasing or decreasing the amount of investment for a certain time.

Profitability is measured as a percentage and shows the ratio of profit from to the amount of money invested. It shows not exactly how much the investor has earned, but the efficiency of investments. When analyzing investment options, investors look at profitability first, often forgetting about the possible ones.

I would not write a long article if one formula worked for all cases - there are enough pitfalls in calculating profitability in different cases. In principle, you can not bother and use it for these purposes, but it is still desirable to understand the essence of the issue.

The article discusses common situations related to investment returns. There will be a lot of class 8 math, so get ready;) Enjoy your reading! Content:

What is profitability? Formulas for calculating the return on investment

The basic formula for the return on investment looks like this:

Investment amount - this is the initial investment plus additional investments ("topping up"). Investment profit can consist of the difference between the purchase and sale price of an asset or the net profit of an investment project. It may also include regular payments on (for example, stock dividends).

If the profit is unknown, but you know initial investment amount and current balance (the sums of the purchase and sale of an asset are also suitable) - use this formula:

Return on investment measured as a percentage and can serve as a reliable benchmark for comparing two investment projects. The following example looks very indicative:

Project A - $ 1000 profit per year with an initial investment of $ 5000. Profitability - 1000 $ / 5000 $ \u003d 20%

Project B - $ 1000 profit per year with an initial investment of $ 2000. Profitability - $ 1000 / $ 2000 \u003d 50%

Obviously, project B is more profitable, since it gives more high return on investment, despite the fact that the investor's net profit is the same - $ 1000. If we increase the amount of investment in project B to $ 5,000, with a yield of 50% per year, the investor will already earn $ 2,500.

That is, the profitability clearly shows in which project, other things being equal, the investor will earn more.Therefore, an investor with a limited investment portfolio is trying to select assets with a higher return.

Calculation of profitability for several investment periods

In practice, there are often situations where investments work many periods in a row - simple (profit is withdrawn after each period) or compound interest (profit) start to work.

Calculation of return on investment, taking into account inputs and outputs

A task that is more relevant for active web investors - they can reshuffle their investment portfolio even more often than once a week.

To begin with, what is inputsand conclusions? This is any change in the initial investment capital that is not associated with a profit or loss. The simplest example is monthly salary top-ups to an investment account.

Every time you deposit or withdraw funds, the denominator of our profitability formula changes - the amount of investments. To calculate the exact return on investment, you need to find out the weighted average investment size, calculate the return on investment, taking into account inputs / outputs, and thus calculate the return. Let's start with profit, the formula will be like this:

All transactions on investment accounts are usually recorded in a special section like "Payment History" or "Transfer History".

How to find out weighted average investment? You need to split the entire investment period into parts, separated by input and output operations. And use the formula:

Ward does not really want to obey and the formula turned out to be clumsy in appearance. Let me explain it on my fingers - we calculate the "working" amount of investments in each of the periods between input and output operations and multiply it by the length of the period (in days / weeks / months) that this amount has worked. Then we add everything up and divide by the full length of the period that interests you.

Let's now see how it works with an example:

The investor has invested $ 1000 in an investment instrument. After 4 months, the investor decided to add another $ 300. After another 6 months, the investor needed money, he withdrew $ 200. At the end of the year, the investment account reached $ 1,500. What is the profitability of an investment instrument?

Step 1 - calculate the resulting investment profit:

Profit \u003d ($ 1500 + $ 200) - ($ 1000 + $ 300) \u003d $ 400

Step 2 - calculate the weighted average investment size:

Investment amount \u003d (4 * 1000 $ + 6 * (1000 $ + 300 $) + 2 * (1000 $ + 300 $ -200 $)) / 12 \u003d (4000 $ + 7800 $ + 2200 $) / 12 \u003d 1166.67 $

Step 3 - calculate the yield:

Profitability \u003d (400 $ / 1166.67 $) * 100% \u003d 0.3429 * 100% \u003d 34.29%

And not 50% if we ignored the inputs and outputs - ($ 1500 -1000) / $ 1000 * 100% \u003d 50%.

Calculation of the average return on investment

Since the profitability of many investment instruments is constantly changing, it is convenient to use some average indicator. allows you to bring fluctuations in profitability to one small number, which is convenient to use for further analysis and comparison with other investment options.

There are two ways to calculate the average return. The first is by compound interest formula, where we have the amount of the initial investment, the profit received during this time, and we also know the number of investment periods:

The initial investment amount is $ 5,000. The profitability for 12 months was 30% (immediately in our mind we translate $ 5000 * 30% \u003d $ 1500). What is the average monthly profitability of the project?

We substitute in the formula:

Average return \u003d (((6500/5000) ^ 1/12) - 1) * 100% \u003d ((1.3 ^ 1/12) - 1) * 100% \u003d (1.0221 - 1) * 100% \u003d 0.0221 * 100% \u003d 2.21%

The second way is closer to reality - there are returns for several identical periods, you need to calculate the average. Formula:

The project brought 10% profitability in the first quarter, 20% in the second, 5% in the third, and 15% in the fourth. Find out the average profitability for the quarter.

We substitute:

Average yield \u003d (((10% + 1) * (20% + 1) * (- 5% + 1) * (15% + 1)) ^ (1/4) - 1) * 100% \u003d ((1.1 * 1.2 * 0.95 * 1.15) ^ (1/4) - 1) * 100% \u003d (1.0958 - 1) * 100% \u003d 0.0958 * 100% \u003d 9.58%

One of the special cases of calculating the average return is the definition percent per annumthat we come across at every turn in the form of bank deposit advertising. Knowing the return on investment for a certain period, we can calculate the annual return using the following formula:

The investor invested $ 20,000 and in 5 months (round up to 150 days) earned $ 2,700 in profit. How much is it in percentage per annum? We substitute:

Profitability \u003d ($ 2700 / $ 20,000 * 365/150) * 100% \u003d (0.135 * 2.4333) * 100% \u003d 0.3285 * 100% \u003d 32.85% per annum

The relationship between return and investment risk

The higher the profitability, the better, it seems obvious. This rule would work well among risk-free assets, but they simply don't exist. There is always the possibility of losing part or all of the investment - this is their nature.

Higher returns are much more often achieved through additional risk increasesthan due to the higher quality of the tool itself. This is supported by real data - when I conducted Alpari companies, I found a strong relationship between the risk score RMS (standard deviation) and profitability for the year:

X-axis - annual yield, Y-axis - RMS. The trend line shows that the higher the annual profitability, the higher the risks of the PAMM account in the form of the RMS indicator.

Yield charts

Yield graph - an indispensable tool for analyzing investment options. It allows you to look not only at the overall result of investments, but also to evaluate what is happening in the interval between the events of "investing money" and "withdrawing profit".

There are several types of yield charts. Most often found cumulative yield chart - it shows how much the initial deposit would have grown in%, based on returns for several time intervalsor by results of individual transactions.

This is how the cumulative yield graph looks like:

Solandr

From it, you can understand several important things - for example, whether the profit grows evenly (the smoother the chart, the better), how large drawdowns (that is, unrecorded losses in the investment process) an investor can expect, etc.

I wrote in great detail about the analysis of profitability charts in the article about.

Also commonly used yield charts by week or month:

Investor's net profitability chart for the Stability Dual Turbo PAMM account by months

The columns speak for themselves - March was successful, but in the last three months there was no profit at all. If you look only at this chart and do not take into account the older Stability accounts, then you can make the following conclusion - the trading system crashed and stopped making profit. In this case, a smart strategy would be to withdraw money and wait until the situation returns to normal.

In general, profitability charts and PAMM accounts are a separate interesting story.

Features of calculating the return on investments in PAMM accounts

Let's start with the most obvious - profitability charts of PAMM accounts for all brokers do not correspond to the real profitability of the investor! What we see is the profitability of the PAMM account, that is, the entire amount of investment, including manager's moneyand management fee.

When we see numbers like this:

600% in a year and a half, the hand immediately reaches for the "Invest" button, though! However, if we take into account 29% of the manager's commission, then the real profitability will be as follows:

2 times less! I do not argue, 300% in a year and a half also looks great, but this is far from 600%.

Well, if you delve into the essence, then the profitability of a PAMM account is calculated as follows:

- A positive result is reduced by the percentage of the manager's commission, except for cases in clauses 4 and 5.

- A negative result always remains as it is.

- If a positive result is obtained after a loss, it does not decrease due to the commission until the total yield updates the maximum.

- If, after a positive result, the maximum total profitability is exceeded, the commission is charged only from the part that has exceeded the maximum.

As a result, we get a very confused formula, which is necessary for high accuracy of calculations. What if you need to calculate the net profitability of an investor on a PAMM account? I suggest using the following algorithm:

- The total profitability is calculated using the profitability formula for several periods with reinvestment.

- A positive result is reduced by a percentage of the manager's commission.

- A negative result is reduced by a percentage of the manager's commission.

All you need is to multiply the official figures of the PAMM account profitability by one minus the manager's commission. And not the final result, but the data from the PAMM-account chart (in Alpari they can be downloaded in a convenient form) and calculated using the formula of profitability for several periods.

For clarity, look at the same yield graph calculated in three ways:

The difference with and without taking into account the manager's commission is almost 2 times! According to the simplified algorithm, we got the result 92%, according to the exact one - 89%. The difference is not significant, but for thousands of percent it will become quite noticeable:

Green circles show the moments of payment of the manager's remuneration, red - the decrease of your shares in the PAMM account. What is a share? It's yours share in the PAMM account, your slice of the common pie has arrived.

For understanding, such a comparison is suitable - shares are a certain number of PAMM-account shares. On these shares, you receive dividends - a percentage of the company's profits. The number of shares decreases - dividends decrease, and, accordingly, the profitability of investments.

Why are the shares decreasing? The fact is that initially you receive a profit for the entire amount of your investment - as you should. The time comes to pay the manager's commission - and it is taken from your amount, your "piece of the pie". The piece has become smaller with all the consequences.

What I showed you is not bad, it is as it is. This is how PAMM accounts work, and whether to invest or not, the choice is always yours.

Friends, I understand that the article is rather complicated, so if you have any questions - ask them in the comments, I will try to answer. And do not forget to share the article on social networks, this is the best thanks to the author:

And a final wish: invest in really profitable projects!

(Add me in friends

(Add me in friends

The investor's income is considered to be any value (including intangible) and financial assets that he received as a result of conducting. The type of income depends on the type of investment. Cash investments are considered the most common type. In this case, income is measured in monetary terms.

The level of income depends on many factors: interest rate, terms of repayment, availability of collateral, term and amount of investment.

The rate of return is determined depending on how risky the project is considered. The higher the rate, the higher the risks, and vice versa.

An almost risk-free level of return on investment is considered to be when investments bring up to 7% of annual profit. A rate of up to 15% classifies investments in the mid-risk zone. And high-risk investments can bring from 30% profit per year or more. But the chance of losing all invested capital is also very high.

Simple examples would be rent from previously acquired property, leasing services, the same interest on deposits, dividends, etc.

All this is good, but profitability of investments is formed not only due to current income. In order to evaluate all the profit received, there is the concept of total income.

Investor's total income is called an indicator that includes the natural increase in the value of the investment object plus current income from the use of this object.

Elena Pazina

Updated: 2019.07.08

Font A A

One of the indicators of a country's economic health is the well-being of the middle class. It is his representatives who provide the lion's share of income from the sale of cars, real estate, in retail. The middle class has been actively developing in our country for the past thirty years. World practice shows that additional sources of income, including investment income, are very popular among its representatives. Citizens become rentiers, open bank deposits, invest in securities. The editors have collected information about the methods of passive earnings, structure, features.

Investment characteristics

Among domestic economists, as it turned out, there is no agreement on a clear definition of the concept of "investment". Most often, the word "investment" is used when it comes to a long-term investment of money in order to make a profit in a few years or have an annual income for a long time.

Accordingly, investment income is a profit obtained with the help of funds withdrawn from their current turnover, invested in any direction in order to obtain additional income.

Examples of sources of passive income are given by Gleb Zadoya:

There are three types of investments that can bring profit:

- real - money is invested in tangible (real estate, equipment, goods, etc.) or intangible (licenses, patents, and so on) assets;

- financial - buying securities, opening deposits, etc.

- intellectual or intangible - investments in objects of intellectual, cultural property.

Investment classification

The return on investment is called total investment income.

Its structure is formed by two components:

- current profit - payments of interest, dividends, etc.

- capital gain or exchange rate income - an increase in the initial investment.

When planning investments, one must remember that not only profits, but also losses are possible. This applies not only to the reduction in the amount of dividends, the lack of interest payments, but also to the reduction in the value of invested funds.

For example, 1000 shares were bought for 100 rubles. The invested capital amounted to 100,000 rubles. In two years, the value of the securities fell to 90,000 rubles. This means that the investor, despite the payment of dividends, incurred losses.

Gleb Zadoya briefly compared the types of investment in his video:

Income from investing money must exceed the inflation rate, only in this case the investment is profitable.

Types of investment income

There are three main classifications of types of investment income. The first is based on the types of investments made, the second on the duration of the investment, and the third on the regularity of payments.

Classification by type of attachment:

1. Real investments bring profit in the form:

- an increase in the market value of investment objects;

- rent;

- income from production, which imply not only the sale of any goods, but also the shares of the enterprise.

2. Financial investments allow you to make money on:

- interest payments, for example, on loans, bonds, deposits;

- dividends;

- growth of quotations.

3. Intangible investments pay off thanks to:

- various license fees or royalties;

- profits from the development of innovative technologies and industries.

When investing in the development of innovative industries, profit can be in the form of intangible assets, such as access to free use of technology and so on.

Profit from investing money can be obtained:

- Quickly. Short-term investments lasting from a few minutes to weeks, which are associated with a high risk of loss.

- In a few weeks, months, with medium-term investments in mutual funds, banks, and so on.

- With long-term investments, investment income comes in a few years (more than three).

In terms of the frequency and type of payments, the investment income consists of:

- regular dividends (percent);

- capital growth;

- total profit combining both options.

Knowing the various ways of making a profit from investing money, the investor selects the most suitable option for himself.

Someone prefers to develop production in order to get a stable operating business that brings dividends in 5-10 years. And someone - to speculate in the market Forex by receiving monthly payments.

When choosing an option for investing money, it is worth considering not only the available amount of free funds, but also the personal characteristics of the future investor.

Maximum return on investment is associated with a huge risk of loss. The more reliable the investment, the lower the profit.

So the interest rate on ruble bank deposits is 7-9% per annum, but the amount up to 1,400,000 is protected by state insurance. Payments in mutual funds reach 30%, but there is a risk of losing investments.

Investment income taxes

Property tax

Investment income is taxed at the standard rate for personal income tax - 13%, but there are small nuances.

Taxation scheme for real estate investments:

Investment tax

Tax deduction

For investments in securities:

For owners of individual investment accounts, there is an opportunity to receive a 13% tax deduction:

Investor incentives

For investors who invest in the development of production, the creation of new technologies, state and regional preferential programs are provided.

Here is an example of tax incentives for investors in the Novosibirsk region:

The declaration is submitted annually by April 30 to the regional inspection at the place of registration. The video will help to understand the general issues of budget payments:

It is necessary to clarify tax rates, specifics of filling, with the inspectors. The fact is that in the inspectorates of different cities and regions of the Russian Federation, points of view on paying taxes differ, much is regulated by internal instructions.

Regardless of the amount of money invested, you can always choose an instrument that guarantees a stable investment income. The main thing is to study the issue and pay taxes on time.

The most profitable investments - the best options 2019-2020 + an overview of the advantages / disadvantages of investing in general.

If you have start-up capital, but have no idea where to invest it, you've come to the right place.

Today's article will consider the most profitable investments that are relevant in the order for 2019-2020. In addition to general earning schemes, we will consider the key nuances of working in each of the niches. The material will be useful, first of all, for beginners of passive income.

If you are a person with many years of experience, our readers will be very interested to know the opinion of the "business shark" in the comments.

What is investment?

To understand the essence of investment, you need to understand 2 characteristics of work - its quality and quantity. When a person goes to the office every day and spends his energy on any activity, he is not able to earn above a certain level. Only a few succeed in reaching the head of a large corporation, therefore, everything depends on the limits of a person's ability to work and how much he can perform in the physical aspect.

More than 90% of the able-bodied population of our country work precisely according to the classical scheme of earnings, which rests on the mental / physical limitations of the individual. Physics is cruel. A person cannot work in several places at the same time, however, if profitable investments come into play, this nuance can be easily bypassed.

Example: A person has a stable job as a sales manager - an 8-hour working day with 1 day off per week. In order to increase the flow of funds to the family's budget, he decides to invest in the development of an online store. Only the financial part of the transaction is required from him, the organizers of this event will take care of the rest.

After the store has been promoted and began to give a stable income, the investor begins to receive a percentage of the proceeds in his pocket. Having paid off the initial expenses, it comes out in a plus. Thus, in addition to the manager's salary, a person has an alternative source of income, which is formed without his own participation.

One reason for investment - get more money. The more profitable your investment is, the faster you will be able to achieve your goal. If we take into account the path of development of the countries of the post-Soviet space, then investing has become not a desire, but a demand, without which one cannot hope for a decent pension. A citizen must learn to take care of himself on his own, only then can he be 100% confident in his financially independent future.

Investment pros and cons

| Positive sides | Negative sides |

|---|---|

| A profitable investment is passive income. Perhaps the main advantage of investing, the reason why people start investing, is that private investment brings passive income. An investor spends several times less time and labor on managing his capital than an employee who earns in an active way. In this case, he is not working for money, but money is working for him. | A profitable investment is the risk of losing capital. The main disadvantage of investing is, of course, investment risks. By investing somewhere his capital, the investor always runs the risk of losing it, partially or even completely. Even if the investment asset seems to be very reliable, there are always risks of capital loss, they are just small. |

| A profitable investment is an opportunity to diversify income. If an employee receives income, as a rule, from one source - less often from two or three, but no more, then private investments make it possible to create an unlimited number of sources of income by investing in different assets, different financial institutions and different investment instruments. And this is a big plus, since it makes it possible to significantly secure the personal or family budget: if income is lost in one source, it will continue to flow from other sources. | A profitable investment is a non-guaranteed and variable income. In most cases. Of course, there are options when the investor's income is guaranteed, but there are not very many of them. Basically, investors are guided by the forecasted income, but it may not be there, in addition, in certain periods, private investments can bring losses. In this case, active earnings provide much more guarantees of income. |

| A profitable investment is an unlimited income. If active income is always limited by the amount of time and labor that a person can devote to create it, then in the case of investment passive income there are no such restrictions. Due to reinvestment and compound interest, it tends to grow exponentially. | A profitable investment is a constant worry for your money. In any case, for novice investors. Especially if the asset that they have acquired begins to fall in price and cause losses, novice investors do not find a place for themselves and may even be subjected to serious psychological stress. |

| A profitable investment is interesting and educational. In fact, investment activities are really very interesting: in the process, the investor learns a lot for himself, increases his financial literacy, gains experience, which will never be superfluous. In this regard, compared to the routine work, which many actually hate, private investment benefits well. | You need capital to invest. And for investments to bring income, at least sufficient to live on it and support a family - capital is large enough for an ordinary person. It is not so easy to create it, it takes many years. |

| A profitable investment is an opportunity for self-realization and achievement of goals. As practice shows, the greatest chances to achieve success and set life goals, which, as you know, in the overwhelming majority of cases directly depend on the material component, are the investors. They are the richest people in the world, country, city. An investor always has a lot of free time, which he can spend on himself and his loved ones, on doing what he likes, on self-realization. | To invest, you need to be well versed in this. You need to be financially literate and constantly develop and improve your financial literacy. On the one hand, this is good and will never be superfluous, but on the other hand, it takes time and a banal desire, which many, unfortunately, do not have. And without this, private investment becomes a kind of step into the unknown. |

If we objectively compare the sides of the same coin, investments are definitely worth the attention of any person who has at least a small free capital. In order to minimize the risk of losing funds as much as possible, experts recommend always diversifying risks, and of course, do not forget about the "cold mind" when making important decisions.

The most profitable investments 2019-2020: a detailed overview

We figured out the essence of the concept of "investment", now you can proceed to the selection of the most profitable options for investing in the current year. Let's say right away that each of the options has risks, however, as they say, "who does not take risks, he does not drink champagne." The likelihood of going bankrupt in investments depends very much on the type of assets - the more stable it is, the lower the value of this parameter. Further, we will consider each of the investment methods in sections + give recommendations on how to get into a stable plus, keeping the balance on the verge of collapse and high profitability.

1) Investments in deposits: payback + features of earning on banks

Investing in deposits is the easiest way to build your money for a citizen of our state. It is impossible to call such a method overly profitable, however, the interest rate on a person's investments will drip with minimal risk, and therefore, this method is often used not for the purpose of high earnings, but for the purpose of storing earned funds.

How investments in a bank work by example:

- The investor makes an investment for a certain period at 15% per annum.

- The bank prepares documents and receives the investor's money at its disposal, which can now be used for personal purposes.

- A banking institution issues a loan, correlated with the size of the investment of one individual, to another person, but the rate, at the same time, is much higher - 20-22%.

- After 12 months, the owner of the investments withdraws them to a personal account along with 15% per annum, and the bank remains in positive territory due to the resulting difference of 5-7%.

- Profit.

Naturally, investments at 15% per annum cannot be called profitable, however, banks have another reason why it will be profitable to keep money there - risk insurance for deposits up to 1,400,000 rubles. If a financial institution goes bankrupt, the depositor will still receive his investments to his personal account, the problem will only be the timing of payments.

How to choose a profitable deposit - 6 key selection criteria:

investment term.

The most important indicator for an investor. There are 3 types of deposits, depending on the term - short-term (up to 90 days), medium-term (up to 1 year) and long-term (over 1 year). There are also indefinite investments in the bank, but there is a clause in the contract that allows you to withdraw funds for one of the specified reasons;

To get a profitable deposit, you need to choose the highest rate with the lowest risk from the bank. Although, the system is designed in such a way that the most profitable options are limited by the long term for placing funds;

regularity of interest.

Once a month / quarter or at the end of the term - 2 options for crediting interest on investments in the bank. If you want to receive dividends consistently, choose the 1st cooperation option;

capitalization.

The most profitable option for investing in banks, since the interest is calculated using a complex formula, adding dividends to the principal amount of the deposit. With large amounts of investment, this parameter allows you to increase the profitability of the instrument several times;

the possibility of replenishment.

Another bottom line is that it makes your investments in the bank more profitable. Well suited for depositors who cannot make a one-time deposit of a large amount of funds to their bank deposit;

the possibility of withdrawal.

For those who do not know the exact term for placing investments in the bank, it is rational to use time deposits. In this scheme, the depositor has the right to withdraw his investments at any time with minimal losses in percentage.

To choose a profitable investment option in a bank, you need to start looking for institutions only after you have decided on the goal pursued and the timing of capital investment. In addition to the classic set of requirements and proposals, each bank of Russia has its own nuances of cooperation. Studying them before investing is mandatory.

Most people use investing in a bank as an intermediate step. The main goal is the temporary storage of funds and the leveling of inflationary influence, which always occurs within the framework of the economy of our country. As soon as the investor finds a more profitable investment option, money smoothly migrates from one place to another.

2) Investments in mutual funds - the trust of capital in the hands of the pros

This tool ranks second in popularity in Russia for making profitable investments with medium and low risks. By its essence, Unit investment fund (mutual investment fund) Is a collective instrument run by a specialized company with the aim of increasing investment. Employees of mutual funds are professional traders who diversify risks and invest the funds of the fund in the most profitable areas of the financial market.

The structure of this financial instrument is based on a share - a unit that reflects the share ratio of the investor's investments in relation to the total capital of the fund. If a person wants to get a profitable deposit option, then he will have to buy a share. To return the investment + take the fat, it is enough to write a statement to the administration at any time and indicate the details of the bank account for the transaction of funds.

Types of mutual funds:

open.

The most convenient option for investing in equity capital. The purchase of a share takes up to 10 days from the date of application, and its submission is permissible at any time, subject to the availability of free shares in the mutual fund;

interval.

Investments are made only within a certain time frame. The situation is similar with the withdrawal of funds. A financial instrument is more profitable than open-ended funds, as it allows you to invest in stocks and other securities with high rates of return. In the best hands, your own contribution can even be doubled;

closed.

A rare investment option that is used to develop any projects from scratch. It is better for an ordinary citizen not to invest in this direction.

Compared to deposits, mutual funds are a more profitable financial instrument. Even when investing in the least risky assets (bonds), the depositor's earnings can exceed 20%. If we take into account the profitability of deposits, then the interest is hardly enough to cover the inflation rate.

How to choose a mutual fund for investment:

- We form the goals for which a person wants to make investments. Calculate the amount, duration, risk level and expected return on your event.

- We choose a Management Company with a high reliability rating - from “A” to “AAA”. It is desirable for the management company to enter the top ratings by several parameters (the amount of attracted capital, net assets, and so on).

- We analyze the life of the mutual fund. You can hardly get a profitable investment from the management company, which has been on the market for only a couple of months. The operating experience of the management company must start from 3 years.

- We investigate the profitability of the mutual fund. Each UK is obliged to post reports for the past quarters. If you see that 95% + investments were profitable, then you can safely trust the money.

- Fund size. Experts believe that the most profitable investments come from funds with an average capital size. Small ones charge large commissions for holding the Criminal Code, and large ones do not have sufficient maneuverability, which can lead to the descent of the investor's investment in the pipe.

If you find a management company with high performance in all criteria, but at the same time, a large commission, we advise you not to twirl your nose, but make investments, since even with a small overpayment, you will have stability in income, which you will receive in this area of \u200b\u200bactivity very problematic.

3) Investing in stocks - risk and profit

If we consider investments in terms of the level of risk, then stocks are the most dangerous asset in this aspect. At the same time, it is simply impossible to consider securities not profitable - the peak earnings of successful traders reached 300% per annum. The difference in the level of income is noticeable even for small investors with a start-up capital of a couple of tens of thousands of rubles.

A share is a security that enables its owner the right to participate in the profits of the company that distributes it. According to the form of issue, cash and non-documentary securities are distinguished, and in relation to the type - registered and bearer.

Types of shares by the nature of dividends:

The most popular profitable investment option among Americans. In Russia, this type of asset is less popular, as it is accompanied by above-average risks. The main income from common shares is dividends. With regard to the management aspect - the right to vote at general meetings of shareholders;

privileged.

A more profitable investment that gives the depositor a fixed dividend, and the owners of the asset are required to pay preferred shares first. This approach to the organization of payments gives confidence in the return on investment, even with a high level of risk.

Ordinary citizens of our country can make capital investments only in open joint stock companies. Access to closed communities has only a predetermined circle of individuals / legal entities. If you want a profitable investment in the long term, be prepared to shell out substantial money to buy famous assets such as Gazprom, Apple and the like.

4) Investing in the Forex market

It should be understood that Forex is not a type of profitable investment, but a complex system for managing financial assets, namely, currency pairs. Taking an example, it is easiest to draw an analogy with the rate jumps in the foreign exchange market. For example, a person buys 10 euros for 9.5 dollars and, after some time, sells the same 10 euros at a more profitable price of 11 dollars. Of course, this alignment is far from reality, but you get the point.Features of investments with Forex:

- the market works 24/7, and therefore, a person can receive income at any convenient time;

- investing in Forex cannot be called completely passive earning options, since without the participation of the management company or private traders, you will have to engage in speculative trading on your own, and this is not always realistic if you take the depositor's own skills as a basis;

- Forex is a profitable investment due to the ability to receive income both when the market rises and when it falls.

The annual return on investments in Forex is up to 150%, however, despite such a tempting indicator, only a few people want to get involved in this adventure among Russians, it is not surprising, because according to statistics, about 93% of investors lose their deposit during the first year work.

In order not to go bankrupt on Forex, the investor can go in two ways - spend a couple of months learning with trading practice, or entrust his investments to another trader. The second case should be considered through PAMM accounts. You can read more about this financial instrument in other articles on our website.

5) Profitable investments with bonds - is it real?

In the financial world, bonds are iOUs large companies. The essence of this asset is for the organization to borrow a certain amount of funds from external investors for a fixed period. Due to the stability and convenient payment system, bonds are not only a profitable investment, but also a high-quality alternative to deposits or mutual funds.

There are a lot of classifications of bonds - by maturity, order of ownership, form of loan, type, and so on. Government-type bonds (from the Bank of Russia) are considered the most stable for investment. Municipalities are in second place. In terms of profitability, the leading positions are held by foreign and corporate securities.

By the form of payment of earnings, bonds are divided:

with a fixed rate.

A person can calculate in advance the income from such deposits. Interest is paid periodically - 1-2 times a year. For example, a bond at a price of 100 rubles with a rate of 20% will bring its owner the same amount from above in 5 years, thereby doubling the investor's starting capital;

with a floating rate.

Interest is linked to some financial indicator, for example, the refinancing rate. In this case, income will be accrued at the end of each calendar year, until the refinancing rate is changed;

mixed.

They are a combination of the previous two indicators. For example, half of the term is calculated at a fixed rate, and half at a floating rate;

discount.

Less profitable investment, as the profitability is formed due to the difference in price. Feature - the purchase of a bond is made at a cost that is lower than the nominal value at the current moment.

If we compare bonds with stocks, then the latter are considered more profitable investments, however, in terms of stability of payments and the risk of loss, the leadership undoubtedly belongs to IOUs. By investing in bonds, a person becomes a kind of lender who issues money to a legal entity at a certain percentage. Even if the company has problems, it will in no way affect the amount of your final income. On the contrary, shares are directly dependent on the state of affairs in the market - if their value has fallen sharply, the investor runs the risk of going into a huge negative.

6) Investing in OFBU - an alternative to mutual funds from banks

Trust management of investments is a very popular area of \u200b\u200bactivity both among private traders and management companies, which can be the banking institutions themselves. It is impossible to call the OFBU extremely profitable investments, but their potential is much higher than that of classic bank deposits. It is provided due to the variability of assets in which the investor can invest - securities, currency, precious metals, options, futures, and the like.

The essence of investments in OFBU is to provide the fund with its own assets in trust. In return, the investor receives a certificate in his hands, which is a confirmation of ownership of a share in the total investment boiler. To make such a deposit for 2019 does not pose any problems - the service is provided by more than 70% of banking institutions in our country.

The advantages of investing in OFBU:

- the owner of the capital will be able to make a fairly profitable investment due to the wide variety in the choice of assets. Foreign securities will allow you to receive up to 20% per year, which is 2 times more than the ordinary interest rates in bank deposits;

- the profitability of investments is negotiated in advance, and, after signing the contract, remains unchanged until the moment of settlement between the management fund and the investor;

- the investor has the right to independently monitor the state of his share of assets in the fund. This moment is carried out through the study of reporting, which is supplied to the depositor by the management company.

The key risk of investment in OFBU is poor management by the management company. Only with the skillful use of trading skills, a trader will be able to fulfill the investor's expectations and bring him real income. Payments from investments are made according to 2 schemes - a percentage of the share at once and a percentage in the investor's share. In the second case, the profit is accrued at the end of the term.

From year to year, the profitability of OFBU, mutual funds and deposits jumps, therefore, it is impossible to say which investments are profitable and which are not. You should follow the news of the financial world and make only medium-term deposits for a period of 6-12 months. Thus, it will be possible to adjust the direction of investment, choosing only those that bring the greatest income at the current moment or in the short term.

Where to invest small money in 2019 to save and earn?

7) Investment in precious metals

The main question that a depositor working with precious metals will have is where to buy an asset? The safest and at the same time profitable investment option is a bank or a secured large management company. The percentage of charges for precious metals in banking institutions is small - 2-4%, however, if you convert this indicator into rubles, you can get up to 30% per annum, depending on the level of increase in the value of the asset during the year.

It just so happens that for the citizens of our country, gold is a sign of stability, therefore, during a crisis, most large investors in the country move their assets from all variable financial sources to this precious metal. The goal is to wait out the crisis and keep equity capital without losses. In the order of 2019, the gold rate is growing, because investments in it are now very profitable. It is difficult to predict the duration of such a rise, therefore, we advise you to withdraw capital from precious assets at the very first signs of an improvement in the economic situation in the country.

Methods of investing in gold and other precious metals:

investing in gold bars.

In the banks of Russia, you can find bars of gold, silver and platinum of the highest standard with impurities of no more than 0.01%. Packaging by weight starts from 1 gram and ends with 1 kilogram.

You can store precious metal both in your own "under the mattress" and in the same bank where the person bought the asset. The ownership of the bullion is confirmed through the issuance of a certificate. If the document is lost, the banking institution may refuse to accept the bullion back and convert it to fiat;

investment in gold coins.

This asset has not only financial value, but also collectible. In Russia, coins are minted, timed to coincide with any significant events. Selling / buying them can cost much more than face value, therefore, in some cases, buying a rare gold coin can be a very profitable investment;

precious metal accounts.

There are 2 types of such accounts - COX and OMC. The bottom line is that the depositor gives the bullion for storage to the bank and receives interest from them to a convertible currency account.

A person can replenish his deposit both through ordinary currency and metals, however, it is the precious metal that is taken as the basis for counting within the system. ROC works differently - the depositor, on the contrary, pays for the storage of the bullion. For those looking for a lucrative investment, only OMC should be considered.

There is another method of investing in gold - gold-backed securities... Only the World Gold Council has the right to issue such papers. To make a profitable investment in such an asset, you will have to spend more than one week on the London or American Stock Exchange, since the demand for this product is incredibly high.

In addition to the specified list, there are other investment options - hedge funds, real estate, life insurance, and so on. All of them are difficult for the investor to understand + do not have good indicators of financial return. If there is a desire to move quickly in the economic world, choose only the most profitable investments, well, do not forget about the diversification of risks, since working with a single asset is suicide.